Figuring out how to get food assistance, like food stamps (officially called SNAP, or the Supplemental Nutrition Assistance Program), can be tricky! One of the biggest questions people have is, “What kind of income do they look at?” Do they care about how much money you make before taxes and deductions, or after? This essay will break down exactly what SNAP considers when deciding if you qualify and how much help you can get. We’ll explore the different types of income they consider, how they figure out eligibility, and some important things to keep in mind.

Gross Income: The Starting Point

Let’s get right to the point: When SNAP decides if you’re eligible, they primarily look at your gross income. That means the total amount of money you earn before any taxes, deductions, or other things are taken out. This is like looking at your paycheck before all the stuff like federal income tax, social security tax, and health insurance premiums are subtracted.

This initial look at gross income is a quick way to see if you’re even in the ballpark of being eligible. States set their own limits, but the federal government provides guidelines. The actual income limits vary based on the size of your household. Because this is just a starting point, they use this to see if someone is over the maximum for SNAP, or is at least within a reasonable range to get a more detailed review of their income. This is what the state uses to decide if they will even consider an application.

For example, let’s pretend there’s a family of four and the limit is $3,000 a month. If that family’s gross income is $3,500, they likely won’t qualify, even if they have high expenses or lots of deductions. But if their gross income is $2,500, the state will continue its review, going further in order to see how much help the family is entitled to.

Because they are looking at gross income, this also is used to decide if you will go on to the second stage of the process: a review of your net income. This involves looking at all income sources and calculating a net amount. This is often what is used to determine how much food assistance someone gets.

What Counts as Gross Income?

So, what exactly is considered “gross income” by SNAP? It’s not just your job’s paycheck. The government wants to know where the money is coming from. It’s a lot of different things. This can include, but isn’t limited to:

- Wages and salaries from your job

- Self-employment income (after deducting business expenses)

- Unemployment benefits

- Social Security benefits

- Retirement income

- Child support payments received

- Alimony received

Any money coming in, pretty much. Keep in mind that different states might have some slight variations in what they consider, so it is always important to check with your local SNAP office to know the rules in your area. Also, they want to know everything you make, even if it’s not a regular paycheck. This is to make sure that you are qualified and can get the maximum help.

The key thing is that gross income is about the total amount before any taxes or other deductions. It is an important starting point, as it dictates if your application moves to the next phase. This is the first step in the process.

Another important factor in calculating gross income is the frequency of the income. For instance, a person who gets paid bi-weekly will have to provide their income for a few pay periods.

Deductions and Adjustments: Making it Net

After looking at your gross income to see if you’re potentially eligible, SNAP does consider some deductions and adjustments to arrive at your net income. They don’t just completely ignore it all. This is to make sure that the program accounts for your specific needs and expenses.

These deductions can lower your net income, which could lead to more benefits. SNAP allows for certain deductions, that will affect how much help you will receive. Each state has its own regulations regarding what is allowed, so it’s essential to check with the SNAP office to see what is covered. Here are some of the common deductions:

- Standard Deduction

- Earned Income Deduction

- Medical Expenses for elderly or disabled

- Dependent Care Expenses

- Child Support Payments

- Homeless Shelter Costs

- Education Expenses

These deductions are important because they help provide a more accurate picture of your financial situation. These help determine the actual amount of assistance the government provides.

Remember, documenting these deductions is crucial. You’ll need to provide proof, such as receipts, bills, or statements. This is a necessary part of getting food assistance and is important to be accurate with your reporting. This also helps prevent errors with the application.

Assets and Resources: What Else Do They Consider?

While income is a big deal, SNAP also looks at your assets, or the things you own that could be turned into money. This is another factor to consider when determining eligibility and the amount of benefits.

These might include things like:

| Asset Type | Included? |

|---|---|

| Cash | Yes |

| Savings and Checking Accounts | Yes |

| Stocks and Bonds | Yes |

| Real Estate (excluding your home) | Yes |

However, not all assets are counted. Your home, for example, usually isn’t considered. Also, certain retirement accounts might be exempt. Again, rules vary, so check with your local SNAP office for the exact guidelines in your area. This can affect whether you get assistance.

The amount of assets you’re allowed to have varies by state, but generally, there are limits to how much you can have and still qualify for SNAP. If you have too many assets, you might not be eligible. This keeps the program focused on helping those who truly need it.

These are generally used to make sure the applicant qualifies for food assistance. They can be important in determining the ultimate decision on a case.

Household Size: Who’s in the Picture?

Your household size is really important when SNAP decides how much help you can get. They look at everyone who shares living and food expenses. It’s not just your immediate family; it includes anyone who lives with you and buys and prepares food together.

SNAP uses your household size to determine both your eligibility and the amount of benefits you will receive. Benefits are based on how many people are in the house and will go up if there are more people. They also use this number to determine the gross income limits. Basically, a household with more people can have a higher income and still be eligible. This is because, in theory, more people means more mouths to feed.

For example, a single person might have a gross income limit of $2,000 a month to be eligible. But a family of four might have a limit of $4,000. This difference accounts for the increased expenses of feeding more people. The government will also provide greater benefits for larger households.

It’s super important to accurately report your household size. If you don’t, it could affect your eligibility and your benefits. This can be a factor in the process.

Reporting Changes: Keeping SNAP Updated

Life changes! If your income, household size, or other circumstances change, you must report those changes to your SNAP office. This is so that the government can adjust your benefits if necessary. Not reporting a change could lead to overpayment, and you might have to pay back the money.

There are different types of changes that should be reported. Some changes are more important than others, but it’s better to report everything. These changes include:

- Changes in income (both increases and decreases)

- Changes in employment

- Changes in household size (someone moves in or out)

- Changes in address

- Changes in assets

The process for reporting changes varies by state. It may be done through mail, phone, or online. In most states, you will have to sign an attestation document. You will also likely need to provide documents to support the changes, like pay stubs or proof of address. This process helps keep SNAP accurate and makes sure everyone gets the right amount of support.

Keeping your information up to date is a key responsibility when receiving SNAP benefits. Make sure you have a way to contact your caseworker. This can help maintain an accurate record.

The Application Process: A Quick Overview

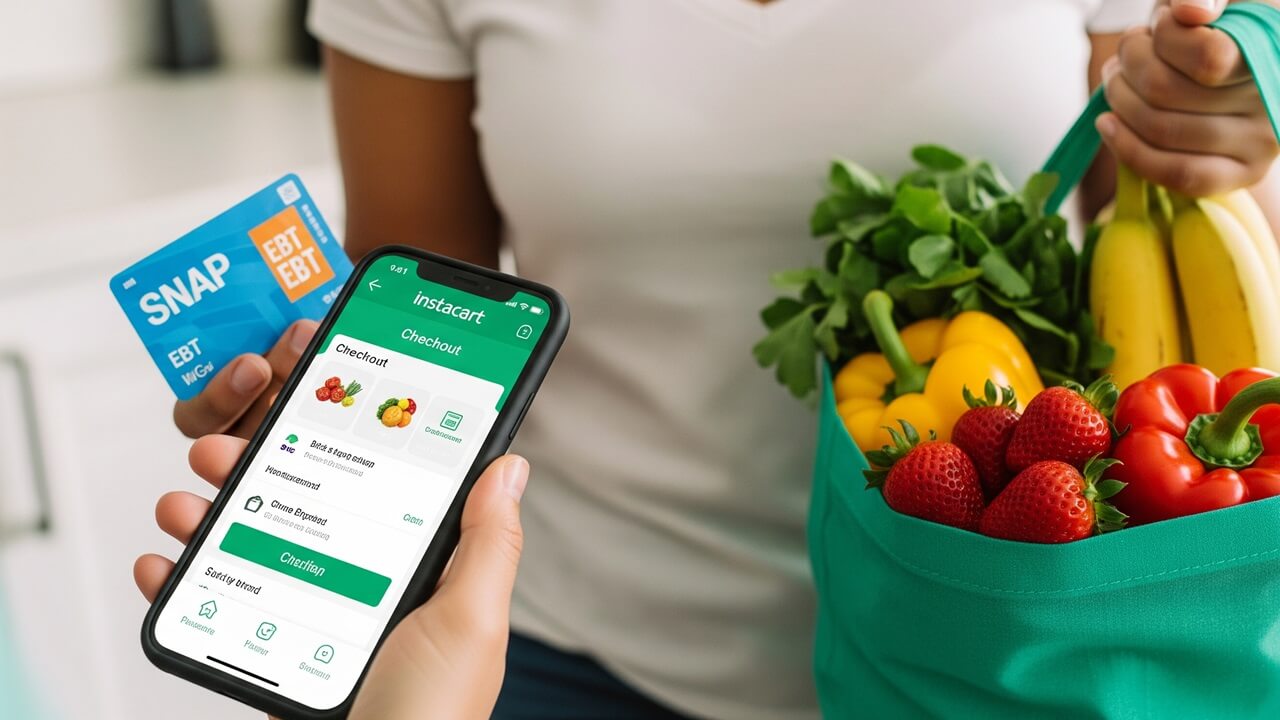

Applying for SNAP is usually a multi-step process. You’ll start by filling out an application, which is usually available online or at your local SNAP office. Then, you’ll provide documentation to verify your income, assets, and household information. They’ll review your application and let you know if you’re approved, and how much you’ll get. Finally, if you’re approved, you’ll receive an Electronic Benefits Transfer (EBT) card, which works like a debit card to buy groceries.

Here’s a simplified look at the process:

- Application: Submit your application.

- Documentation: Provide proof of income, expenses, and other information.

- Interview: Most applicants will participate in an interview with a case worker.

- Decision: The state will approve or deny your application.

- Benefits: If approved, you will receive monthly benefits on your EBT card.

The application will often involve a lot of paperwork, and you may have to provide documents to verify everything. Many states will schedule an interview to discuss your situation. While it might seem long and complicated, the goal is to make sure the program helps those who truly need it. There are also a lot of places that can help with the process. There are many resources available, and caseworkers who can help with the application and provide assistance.

The application process can vary from state to state, and also depends on your own circumstances. Be sure to be honest and accurate on all of your paperwork. Your honesty is crucial.

Conclusion

So, does SNAP look at gross or net income? The answer is both, but they primarily use your gross income to initially determine if you are even in the range to qualify. Then they look at your net income to figure out how much food assistance you’re eligible for. They consider your assets, household size, and any deductions you qualify for. Remember to report any changes in your situation. While the process might seem complex, the goal is to provide food assistance to those who need it most. If you are eligible, SNAP can be a valuable resource to help make ends meet and put food on the table. Be sure to contact your local SNAP office for help with any questions.